Why Credit History Matters More Than You Think When Setting up Utilities

Starting new utility services such as electricity, gas, or water may seem straightforward, but your credit history can influence far more than you realize. Providers often use your financial background as a measure of risk, which directly affects deposits, plan choices, and overall costs. In Texas and other deregulated markets, this process is especially important, as customers are presented with a wide variety of options. While some households may be concerned about large upfront costs, there are alternatives available. For instance, some electricity providers with no deposit offer flexible plans for individuals who may struggle with credit checks. Understanding how credit history fits into this process can help avoid surprises and ensure you make informed decisions. Below are the top reasons why credit history matters more than you may initially think when setting up utilities.

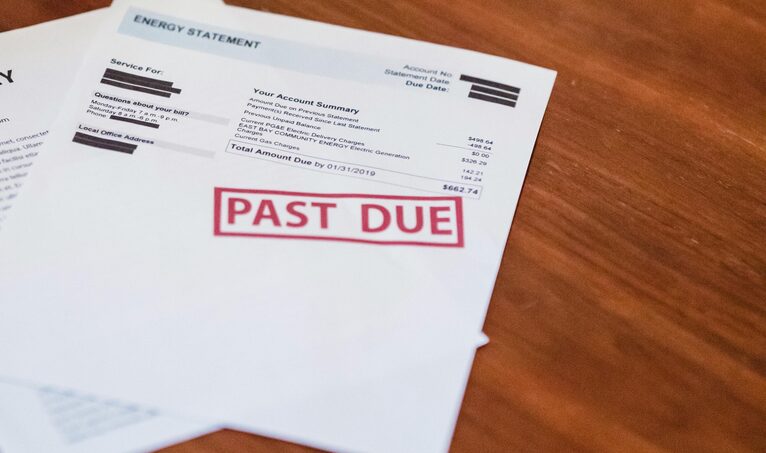

Deposits Are Directly Tied to Credit Standing

The most immediate way credit history affects utilities is through deposit requirements. Providers often request a deposit as a form of security if they perceive a customer to be a higher risk. For people with strong credit scores, deposits may be minimal or waived entirely. On the other hand, those with weak or limited credit may face deposits ranging from $100 to $300 or more, which can be a significant financial burden. This practice isn’t simply about cost—it reflects a provider’s effort to reduce uncertainty about payment reliability.

Credit History Determines Access to Certain Plans

A lesser-known factor is that your credit history can influence which plans are available to you. For instance, some long-term, fixed-rate contracts are only extended to customers with stable credit backgrounds. These plans often lock in consistent rates that protect households from market fluctuations. Without an adequate credit profile, you may be limited to shorter-term agreements or prepaid options. While these alternatives can still meet household needs, they may not offer the same level of stability as plans designed for individuals with stronger credit.

It Protects Providers Against Missed Payments

Utility companies are essentially lending services in a different form—they provide electricity, water, or gas up front and expect payment later. For this reason, your credit history becomes a predictive tool for assessing whether payments are likely to arrive on time. A history of consistent bill settlement signals reliability, while frequent late payments or unpaid accounts may flag potential risk. This is why companies place such emphasis on credit checks. Their goal isn’t to punish but to create systems that safeguard them against unpaid usage while still extending services broadly.

Credit Standing Influences Your Negotiating Power

Consumers often underestimate the significant leverage a strong credit history provides. For example, if you want to negotiate a lower deposit, request a flexible payment schedule, or seek additional benefits such as discounts for autopay, your credit profile can significantly impact the outcome. Those with positive credit reports are generally in a better position to request favorable terms. On the other hand, customers with weaker credit may find that companies are less willing to accommodate their needs. Credit history doesn’t just dictate eligibility—it shapes the degree of flexibility you can exercise with providers.

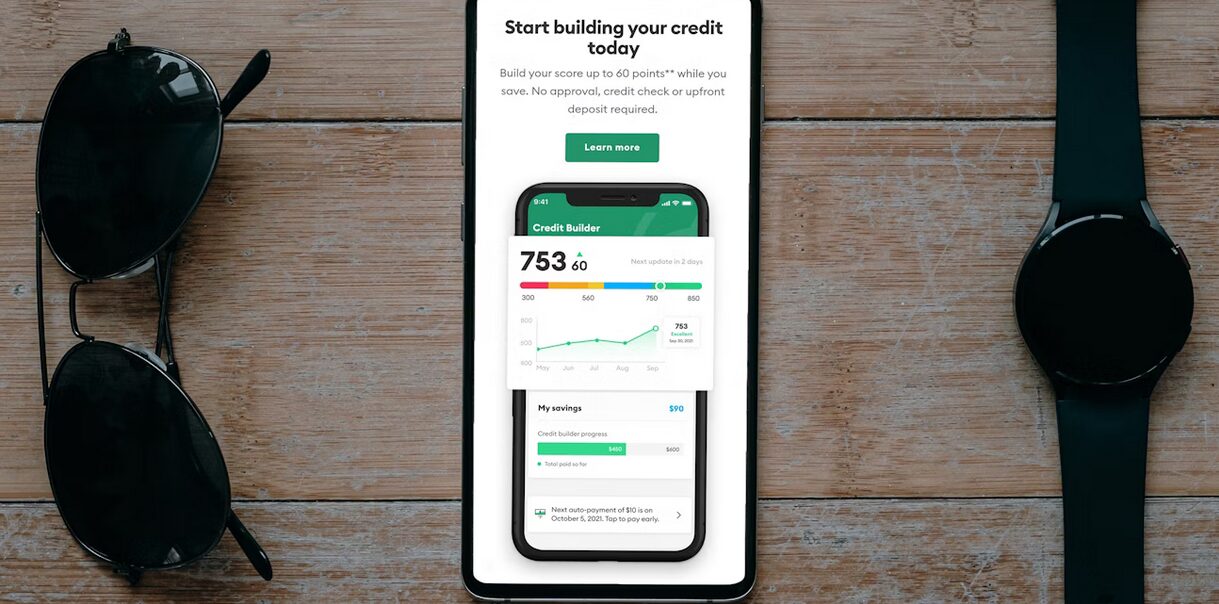

Long-Term Financial Impact Stretches Beyond Utilities

The significance of credit history in utilities extends beyond the initial setup. Consistently making on-time utility payments can gradually strengthen your overall credit profile, as some providers report payment history to credit bureaus. Over time, this can lead to improved access to better contracts in multiple areas, including phone service and rental agreements. Conversely, unpaid bills that end up in collections can damage your credit score, limiting future opportunities. Utilities are often viewed as basic services, but their financial impact extends to many other aspects of daily life.

Your credit history isn’t just a background detail—it has a central role in determining how easily and affordably you can set up essential services. From deposit amounts and available plans to long-term financial opportunities, credit status has a wide-reaching impact. By understanding this connection, households can prepare better, avoid unexpected costs, and make informed choices that support both immediate and future stability.…

If you’re unable to get a traditional job because of your gambling habit, you’ll need to get creative with your finances. One way to do this is to start a side hustle. There are many ways to make extra money, so you’ll need to find one that suits your skills and interests. You could start a blog about gambling and offer tips and advice, or become a professional gambler yourself and offer your services to others.

If you’re unable to get a traditional job because of your gambling habit, you’ll need to get creative with your finances. One way to do this is to start a side hustle. There are many ways to make extra money, so you’ll need to find one that suits your skills and interests. You could start a blog about gambling and offer tips and advice, or become a professional gambler yourself and offer your services to others.

The most important thing is to make sure you are qualified for a mortgage. There are three key areas that banks focus on when it comes to qualification: your employment, credit score, and debt-to-income ratio. If you can improve any of these areas, you will likely increase your chances of being approved for a mortgage. When it comes to your employment, the lenders want to see that you have a stable job with a steady income. If you are self-employed, have your tax returns ready to show the bank from the past few years.

The most important thing is to make sure you are qualified for a mortgage. There are three key areas that banks focus on when it comes to qualification: your employment, credit score, and debt-to-income ratio. If you can improve any of these areas, you will likely increase your chances of being approved for a mortgage. When it comes to your employment, the lenders want to see that you have a stable job with a steady income. If you are self-employed, have your tax returns ready to show the bank from the past few years. As the last resource, if everything above is not working for you, you can always try to get a cosigner. A cosigner is someone who agrees to be responsible for your loan if you can’t make the payments. It is a good option if you have a family member or friend who has good credit and is willing to help you out. Keep in mind that if you default on your loan, the cosigner will be responsible for it.

As the last resource, if everything above is not working for you, you can always try to get a cosigner. A cosigner is someone who agrees to be responsible for your loan if you can’t make the payments. It is a good option if you have a family member or friend who has good credit and is willing to help you out. Keep in mind that if you default on your loan, the cosigner will be responsible for it.